Hydrogen

Why is it important?

Hydrogen is a versatile energy carrier, which can help tackle various critical energy challenges. Today, hydrogen is mainly used in the refining and chemical sectors and produced using fossil fuels such as coal and natural gas, and thus responsible for significant annual CO2 emissions.

What is the role in clean energy transitions?

Clean hydrogen produced with renewable or nuclear energy, or fossil fuels using carbon capture, can help to decarbonise a range of sectors, including long-haul transport, chemicals, and iron and steel, where it has proven difficult to reduce emissions. Hydrogen-powered vehicles would improve air quality and promote energy security. Hydrogen can also support the integration of variable renewables in the electricity system, being one of the few options for storing energy over days, weeks or months.

Where do we need to go?

The momentum behind hydrogen is strong. Nine countries – which cover around 30% of global energy sector emissions today – released their national strategies in 2021-2022. However, faster action is required to create demand for low-emission hydrogen and unlock investment that can accelerate production scale-up and bring down the costs of technologies for producing and using clean hydrogen, such as electrolysers, fuel cells and hydrogen production with carbon capture.

Tracking Hydrogen

Hydrogen and hydrogen-based fuels can play an important role in the decarbonisation of sectors where emissions are hard to abate and alternative solutions are either unavailable or difficult to implement, such as heavy industry and long-distance transport.

The announcements for new projects for the production of low-emission hydrogen keep growing, but only 5% have taken firm investment decisions due to uncertainties around the future evolution of demand, the lack of clarity about certification and regulation and the lack of infrastructure available to deliver hydrogen to end users. On the demand side, hydrogen demand keeps growing, but remains concentrated in traditional applications. Novel applications in heavy industry and long-distance transport account for less than 0.1% of hydrogen demand, whereas they account for one-third of global hydrogen demand by 2030 in the Net Zero Emissions by 2050 (NZE) Scenario. A growing number of countries are releasing national strategies and adopting concrete policies to support first movers. But the delays in the implementation of these policies and the lack of policies for demand creation are preventing the scale-up of low-emission hydrogen production and use.

To get on track with the NZE Scenario, accelerated policy action is required on creating demand for low-emission hydrogen and unlocking investment that can accelerate production scale-up and deployment of infrastructure.

The United States and the European Union lead policy action, while China has taken the lead in deployment

- China leads on electrolyser capacity additions, with a cumulated capacity of almost 220 MW in 2022 and 750 MW under construction expected to be online this year.

- The European Union adopted two delegated acts in February 2023 with rules to define renewable hydrogen, approved funding for the first two waves of hydrogen-related Important Projects of Common European Interest in 2022 and announced the first auctions of the European Hydrogen Bank for the end of 2023.

- India approved in January 2023 the National Green Hydrogen Mission with the aim of producing 5 Mt of renewable hydrogen by 2030 and of becoming a leading manufacturer of electrolysers.

- The United Kingdom released in July 2022 its Low-Carbon Hydrogen Standard and in February 2023 launched a consultation for a certification scheme. The first Electrolytic Allocation Round to support projects to produce hydrogen using electrolysis was launched, with the aim of awarding contracts by the end of 2023.

- The United States announced in August 2022 important incentives for the production of clean hydrogen under the Inflation Reduction Act (IRA).

- Namibia released in November 2022 its Green Hydrogen and Derivatives Strategy, joining South Africa as the only sub-Saharan countries that have adopted a hydrogen strategy.

Hydrogen applications play a fundamental role in sectors where emissions are hard to abate, but production needs to become cleaner

In the NZE Scenario, the use of low-emission hydrogen and hydrogen-based fuels lead to modest reductions in CO2 emissions in 2030 compared to other key mitigation measures, such as the deployment of renewables, direct electrification and behavioural change. However, hydrogen and hydrogen-based fuels can play an important role in sectors where emissions are hard to abate and other mitigation measures may not be available or would be difficult to implement, namely heavy industry, long-distance transport, shipping and aviation. Hydrogen's total contribution is also larger in the longer term as hydrogen-based technologies mature.

Replacing unabated fossil fuel-based hydrogen with low-emission hydrogen in existing applications (namely refining and industry sectors) is a short-term priority given that it presents relatively low technical challenges as it is a like-for-like substitution rather than a fuel switch. Current production of hydrogen for these applications emits 1 100-1 300 Mt CO2 equivalent1 (including upstream and midstream emissions from fossil fuel supply). In the NZE Scenario the average emissions intensity of hydrogen production drops from the range of 12-13.5 kg CO2-eq/kg H2 in 2022 to 6-7.5 kg CO2-eq/kg H2 in 2030.

1. The range in the emissions and in the average emissions intensity reflects the different allocation methods for the by-product hydrogen production in refineries.

Global hydrogen production CO2 emissions and average emissions intensity in the Net Zero Scenario, 2019-2030

OpenLow-emission hydrogen production remained below 1% of global hydrogen production in 2022

Global hydrogen production by technology in the Net Zero Scenario, 2019-2030

OpenDedicated hydrogen production today is primarily based on fossil fuel technologies, with around a sixth of the global hydrogen supply coming from “by-product” hydrogen, mainly in the petrochemical industry. In 2022, 70% of the energy requirement for dedicated hydrogen production was met with natural gas and around 30% with coal (mostly used in China, which alone accounted for 90% of global coal consumption for hydrogen production).

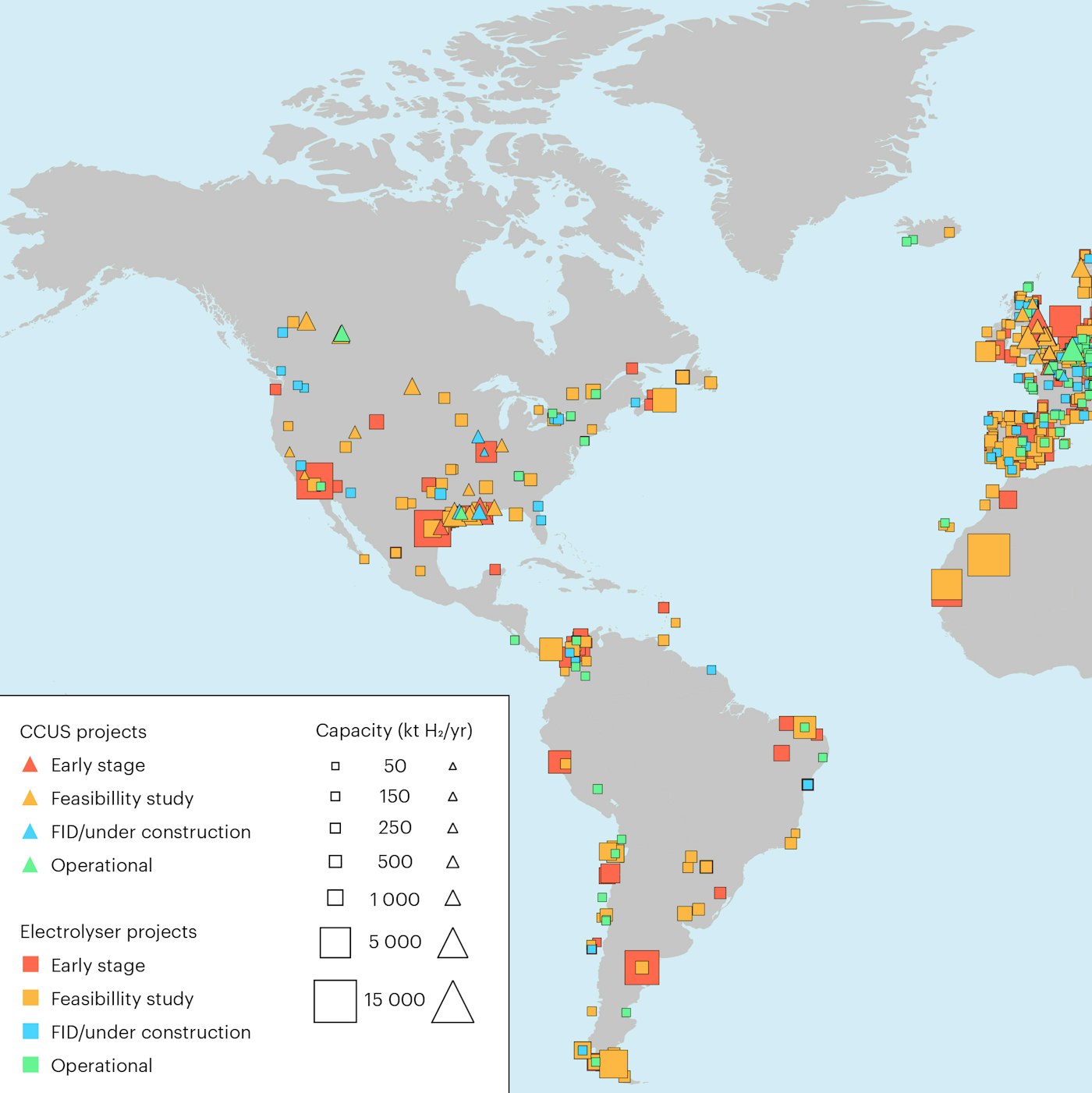

Low-emission hydrogen production represented less than 1% of total hydrogen production in 2022, despite growing 5% compared to 2021. This increase in low-emission hydrogen production is the result of 130 MW of electrolysis capacity and one project starting operation in China for the production of hydrogen from coal with CCUS entering into operation during 2022.

Getting on track with the NZE Scenario requires a rapid scale-up of low-emission hydrogen, with around 50 Mt of hydrogen production based on electrolysis and more than 30 Mt produced from fossil fuels with CCUS by 2030, for a total of more than 50% of hydrogen production. This will require an installed capacity of more than 550 GW of electrolysers, which in turn requires both a rapid scale-up of electrolyser manufacturing capacity (see Electrolysers page) and significant deployment of dedicated renewable capacity for hydrogen production and enhancement of the power grid. With regard to fossil fuels, by 2030 natural gas demand for hydrogen production is almost 30% higher than in 2022 in the NZE Scenario, while coal demand drops by nearly one-fifth. In both cases, newly deployed production capacity is equipped with CCUS and a fraction of existing facilities still operational in 2030 are retrofitted with CCUS.

Global demand for hydrogen grew around 3% in 2022, but still remains concentrated in traditional applications with slow penetration in new uses

Global hydrogen demand by sector in the Net Zero Scenario, 2020-2030

OpenGlobal hydrogen demand reached 95 Mt in 2022, almost 3% more than in 2021. Hydrogen demand remains concentrated in traditional applications in the refining and industrial sectors (including chemicals and natural gas-based Direct Iron Reduction [DRI]), with very limited penetration in new applications. Demand in new applications, such as transport, high-temperature heat in industry, hydrogen-based DRI, power and buildings, represents less than 0.1% of global demand. Most of this demand is concentrated in road transport, although other applications are starting to get some traction.

Several demonstrations of key end uses for low-emission hydrogen and hydrogen-based fuels entered into operation in the past year in chemicals production, refining, high-temperature heating and shipping. Bringing these technologies to commercialisation as soon as possible will be critical to unlocking a significant fraction of demand in these new applications.

Getting on track with the NZE Scenario will require a step-change in demand creation, particularly in new applications. By 2030 hydrogen demand increases by more than 1.5 times to reach more than 150 Mt, with nearly 30% of that demand coming from new applications.

Transport and storage infrastructure for hydrogen and hydrogen-based fuels remains very limited, but its scale-up is crucial as new distributed applications arise

Hydrogen is today mostly produced and consumed in the same location, without the need for transport infrastructure. With demand for hydrogen increasing and the advent of new distributed uses, there is a need to develop hydrogen infrastructure that connects production and demand centres.

Pipelines are the most efficient and least costly way to transport hydrogen up to a distance of 2 500 to 3 000 km, for capacities around 200 kt per year. About 2 600 km of hydrogen pipelines are in operation in the United States and 2 000 km in Europe, mainly owned by private companies and used to connect industrial users. Several countries are developing plans for new hydrogen infrastructure, with Europe leading the way. The European Hydrogen Backbone initiative established in 2020 groups together 32 gas infrastructure operators with the aim of establishing a pan-European hydrogen infrastructure. In June 2022, the Dutch government announced a plan to invest EUR 750 million in the development of a national hydrogen transmission network of 1 400 km. Staying on track with the NZE Scenario would require around 15 000 km of hydrogen pipelines (including new and repurposed pipes) by 2030.

For transporting hydrogen over long distances, shipping hydrogen and hydrogen carriers are more cost-competitive than hydrogen pipelines. In February 2022 the Hydrogen Energy Supply Chain project demonstrated for the first time the shipment of liquefied hydrogen from Australia to Japan. However, due to the technical challenges of shipping liquefied hydrogen, a growing number of projects are considering the possibility of transporting ammonia, although all these projects are still at very early stages of development, with the exception of the NEOM project, which reached financial closure in March 2023. In the NZE Scenario, more than 15 Mt of low-emission hydrogen (in the form of hydrogen or hydrogen-based fuels) are shipped globally by 2030.

The development of infrastructure for hydrogen storage will also be needed. Salt caverns are already in use for industrial-scale storage in the United States and the United Kingdom. The potential role of hydrogen in balancing the power grid and the potential development of international trade would require the development of more storage capacity and its flexible operation. Several research projects are ongoing for the demonstration of fast cycling in large-scale hydrogen storage, such as HyCAVmobil in Germany and HyPSTER in France, with both planning to start tests this year. Other research projects in the Netherlands, Germany and France are analysing the potential for repurposing natural gas salt caverns for hydrogen storage. Research and demonstration is also progressing in the development of other types of underground storage sites (such as depleted gas fields, aquifers and lined hard rock caverns). In 2022, a demonstration facility to store hydrogen in lined hard rock caverns started operating in Sweden. In the NZE Scenario, global bulk storage capacity rises from 0.5 TWh today to 70 TWh by 2030.

Low-emission hydrogen production technologies are maturing fast, but more effort is needed on demand-side technologies

Not all steps of the low-emission hydrogen value chain are operating at commercial scale today. On the supply side, some technologies are already commercially available, such as alkaline and proton membrane exchange electrolysers. Other technologies, such as Solid Oxide Electrolysers (SOEC), are approaching commercialisation thanks to recent innovation efforts. In April 2023, a 2.6 MW SOEC electrolyser was installed in a Neste refinery in the Netherlands and just few weeks later, Bloom Energy installed a 4 MW SOEC system in a NASA research centre in California.

Transport and storage technologies are also quite mature, although still at small scale. Innovation and demonstration efforts are underway to bring these technologies to the scale needed to facilitate the adoption of hydrogen as a clean energy vector. In April 2023, the world’s first hydrogen storage facility in an underground porous reservoir started operation.

On the demand side, the situation is different. Beyond traditional uses of hydrogen in refining and industrial applications which are fully commercial, the majority of demand technologies are only at the demonstration or prototype stage, but there has been some recent progress. In March 2023, the world’s first hydrogen ferry entered into operation in Norway. The HyInHeat project also started in 2023, with the aim of demonstrating the use of hydrogen in ancillary high-temperature heating process in industrial applications. But further efforts are needed to unlock the full potential demand for hydrogen in hard-to-abate sectors.

Governments are adopting hydrogen strategies and targets for technology deployment, but there is a lack of policies to stimulate demand for low-emission hydrogen

At the end of 2022, a total of 32 governments had a hydrogen strategy in place. Targets for the deployment of hydrogen production technologies are growing, particularly on electrolysis capacity, with national targets reaching an aggregate of 160-210 GW, which accounts for 30-40% of the installed electrolysis capacity by 2030 in the NZE Scenario. However, there has been very limited progress in establishing targets to increase demand for low-emission hydrogen, with the exception of the European Union, which in March 2023 agreed ambitious targets to stimulate demand in industry and transport. There was also limited progress in the adoption of policies to stimulate demand creation over the past year. The majority of policies in place focus on supporting demand creation in transport applications, mainly through purchase subsidies and grants, while a very small number of policies target industrial applications, despite these applications accounting for most current demand. The adoption of quotas and mandates is another tool that governments have started to consider for supporting demand creation in industry, aviation and shipping, although none of the announced quotas have entered into force yet.

Governments are stepping up efforts to stimulate strategic demonstration of key hydrogen technologies, with new programmes in place:

- European Union: in January 2023, the EU Clean Hydrogen Partnership opened a EUR 195 million call for proposals to support projects for renewable hydrogen production, storage and distribution solutions, and to stimulate the use of low-emission hydrogen in hard-to-abate sectors.

- United States: in March 2023, the Department of Energy announced a USD 750 million R&D programme for advanced clean hydrogen technologies.

- United Kingdom: the government opened the third round of the Clean Maritime Demonstration Competition in September 2022 and launched the second phases of programmes for R&D in hydrogen production using BECCS (December 2022) and replacement of diesel in off-road vehicles and machinery (March 2023).

Several governments have begun to implement policies in the form of grants, loans, tax breaks and carbon contracts for difference. Activity has been particularly intense over the course of 2022 and the beginning of 2023, with several significant announcements:

- European Union: the European Commission approved in July and in September funding for two waves of hydrogen-related Important Projects of Common European Interest (Hy2Tech, with a focus on hydrogen technologies, and Hy2Use, with a focus on industrial applications). In addition, the first auction of the European Hydrogen Bank to support projects for domestic production of renewable hydrogen has been announced for the end of 2023.

- Germany: the bidding process of the H2Global initiative was launched in December 2022, with deliveries expected for the end of 2024, although tender deadlines have recently been extended.

- Japan: NEDO committed JPY 220 billion from the Green Innovation Fund Project to support a liquefied hydrogen supply chain project between Australia and Japan.

- United Kingdom: Between July 2022 and January 2023, the government opened the first Electrolytic Allocation Round and pre-selected projects, with the aim to support at least 250 MW of capacity. The second allocation round will open by the end of 2023.

- United States: the government announced the creation of a tax credit, an investment credit and grant funding for low-emission hydrogen production projects. In addition, in September 2022, the Department of Energy opened a USD 7 billion call for regional clean hydrogen hubs.

The International Partnership for Hydrogen and Fuel Cells in the Economy is expected to release the final version of its Methodology for Determining the Greenhouse Gas Emissions Associated with the Production of Hydrogen in July 2023. This methodology will serve as the basis for an International Organization for Standardization (ISO) standard. ISO is seeking to develop a draft technical specification by end of 2023 and a draft international standard by the end of 2024.

In parallel, governments are working on the establishment of regulatory frameworks and certification schemes. Australia is developing a voluntary scheme for Guarantee of Origin certificates. The European Commission adopted two delegated acts in February 2023 with rules to define renewable hydrogen, which will be in force once the Council and the Parliament approve them. France is working on the details of a certification schemes for the hydrogen categories defined in its Ordinance No. 2021-167. The United Kingdom released a Low-Carbon Hydrogen Standard in July 2022 and in February 2023 launched a consultation for a certification scheme. And the US Department of Energy proposed in September 2022 a Clean Hydrogen Production Standard and is working on the methodological details for its application in supportive schemes such as the IRA Clean Hydrogen Production Tax Credit.

However, the methodologies defined for these certification schemes are not necessarily aligned. This may become an important barrier as the investments that will lead to trade in low-emission hydrogen will rely on international recognition of standards and certificates.

View all hydrogen policies

Recommendations

Programmes and partnerships

Hydrogen Patents for a Clean Energy Future

A successful transition to a clean energy future will be supported by rapid changes in the global economy and in people’s patterns of energy consumption, all of which have the potential to sustain healthier societies, more equitable outcomes and a more resilient planet.

Authors and contributors

Lead authors

Jose M Bermudez

Stavroula Evangelopoulou

Contributors

Francesco Pavan

Recommendations